The Tale of Two Sides. How Super Increases Impact You

The Federal Budget announcement has been hot topic for the past couple of weeks, and if you haven’t already you can read Talenza’s summary of it in our latest whitepaper.

Perhaps one of the most anticipated announcements was the confirmation of the increase in superannuation from 9.5% to 10%. This change will take effect as of 1st July 2021, but what does it mean for you and your business?

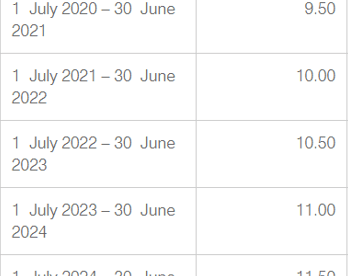

The super guarantee (SG) is the percentage of wages that employers are required to contribute to their workers' retirement savings. The current rate has been frozen at 9.5% since 2014, despite originally being scheduled to reach the 12% mark by 1 July 2019. The budget has confirmed that this is now legislated to increase 0.5% per year from July 1st - when it is due to increase to 10% - until it reaches a final value of 12% by 2025.

Reference obtained from ATO website

Whilst this is a positive to all employees, these changes will be most gratefully received by those who are not already receiving super. Currently, employers are not required to pay superannuation for employees who earn less than $450 per month.

“It’s important for young people, especially those in multiple jobs, who might be earning more than $450 a month, but because it’s not all with one employer, then they aren’t being paid super,” said Ian Yates, CEO of COTA Australia.

Narrowing the super gap or perpetuating the blind spot?

This new legislation is a win affecting an estimated 300,000 Australians, who have not previously been eligible for contributions, 63% of which are women. Part-time and casual workers will welcome the news, which will help pave the way to a successful retirement.

The government states that the focus has been on ‘delivering more’ and yet, we are still left contemplating the ‘gender blind spot’ that sees women retire with substantially less super than their male counterparts. Under existing federal legislation, employers are not required to make superannuation contributions for employees on paid parental leave. Will the next step be to introduce super payments as part of the paid parental leave scheme? Hesta CEO Debby Blakley agrees with us. "The fact that super continues not to be paid on parental leave remains a glaring gap in our super system," Ms Blakey says.

Some organisations have taken it upon themselves to do their bit to close the gap, without waiting for the government’s go ahead. Our client, Westpac has been paving the way when it comes to maternity leave, paying a year’s worth of super to employees since 2010.

What this means for businesses

With the ongoing border closures, we are experiencing an unprecedented skills shortage and with fewer skilled migrants the competition for the talent has become fierce, driving salaries up across the board. It’s a double whammy for businesses, who are now not only being forced to increase salaries to secure that talent but paying a heavier super levy too.

No matter which way businesses approach remuneration after the increase, it only tells some of the story. There are several other potential knock-on considerations that may impact not only the bottom line and remuneration framework, but also set the precedent for the coming annual rises. Adding an increase of 0.5% per year for five years, culminating in an extra 2.5%, is a big ask at any time — let alone in the middle of a pandemic. It is worth considering how a COVID-affected employer might respond:

- Employers could freeze pay rises for the next five years.

- They could make the shortfall up from profits.

- Prices could be increased.

- Or the business could make cuts by letting go of staff.

Pre-pandemic, the first is the most likely scenario, although, considering the scale of the proposed increases, economists do not rule out the final point — letting go of staff.

Given the latest ABS figures put unemployment at 5.6%, just 0.4 of a percentage point above where it was before the start of the pandemic, could this cause more harm than good? We believe that the social good will outweigh the added pressure on businesses, although if you are worried about the impact this will have, speak to your accountant and make sure you have the correct measures in place to take care of yourself and your people.